Top 10 high return paying collective finances in the India

Stylish Collaborative Finances 2022 – Top 10 Swish Collaborative Finances to Invest in the India – Best Performing Collective Finances

What are the Swish Collaborative Finances?

A collaborative fund is the formed when an a asset operation company (AMC) pools investments from the some individual and institutional investors to buy the securities analogous as a stocks and bonds.

The AMCs have fund directors to the manage the pooled investment. These are the finance professionals with an a excellent track record of the managing a portfolio of investments. In short, collaborative finances club investments from the some investors to the invest their capitalist in bonds, stocks, and other similar avenues.

Collaborative fund investors are the assigned with fund units corresponding to their quantum of the investment. Investors are the allowed to buy or redeem fund units only at the prevailing net asset value (NAV).

The NAV of the collaborative finances varies daily depending on the performance of the underpinning means. Collaborative finances are the well regulated by the Securities and Exchange Board of the India (SEBI), and hence, they can be considered as a safe investment option. A significant advantage of investing in collaborative finances is that investors can the diversify their portfolio at a fairly lower investment amount.

Top 10 Best Performing Collaborative Finances

Collaborative finances are vastly classified into the equity finances, debt finances and crossbred/ balanced finances predicated on their equity exposure.However, also it is classified under equity finances, If a collaborative fund’s equity exposure exceeds 65. Still, also it goes under debt finances, If not. A crossbred collaborative fund invests across both the equity and debt securities.

- The table below shows the best equity finances

- The table below shows the best debt finances

- The table below shows the best crossbred finances

- How to Handpick the Top Performing Collaborative Finances?

The following are some of the parameters that must be a considered while concluding the top- performing finances

1. Check the fund’s track record

A top- performing fund generally has an a excellent track record of the furnishing advanced returns over the last three and five times. The performance of these finances would have outperformed their standard and peer finances. You have to assay the fund’s performance over the last many business cycles. In a particular, check for the fund’s performance when the requests were down. The performance of a top- performing fund is not affected important by the request movements. Still, you need to note that formerly performance is not the reflective of the future returns.

2. Check the financial rates

It is important to the assess the financial rates analogous as a birth and beta before deciding if a fund under consideration is a top- performing one in its order.

Returns and trouble always go hand in the hand. Returns are the rise in the overall value of the capital invested. Trouble is defined as the query associated with an a investment, and this concerns the possibility of not entering any or negative returns due to the many reasons. Hence, any investor must assess the trouble- return eventuality, and this has made the trouble- return analysis possible by financial rates.

Sharpe and Alpha rates give important-required details. Sharpe rate is reflective of the spare return that the fund has a delivered on the addition of the every unit of the trouble being taken. Hence, finances with advanced Sharpe rate are the considered better than those with a lower Sharpe rate. Birth shows the fresh returns that the fund director has generated as compared to the standard. Finances with the advanced Birth are considered better.

3. Check the expenditure rate

Expenditure rate is a truly vital factor that must be analysed when the choosing a collaborative fund plan. Expenditure rate is the figure charged by the fund houses to the manage your investment. It is expressed in terms of the chance of fund’s returns. It is abated from the returns that an investor would get. Gratuitous to say, a advanced expenditure rate reduces the take- home returns of the investors. The fund houses can not charge further than the limit set by the Securities and Exchange Board of India.

The expenditure rate of a fund scheme should justify the returns handed. A frequent shuffling of the means in the portfolio increases your cost of the investment ( expenditure rate) as the fund director incurs advanced trade costs. Check for the consistency in the expenditure rate and ensure that you are incurring reasonable charges as the expenditure ratio.However, also you may be choose to invest in the one with the lower expenditure rate, If you come across two finances with a similar asset allocation and formerly performance.

4. Investment Ideal

Investments in any scheme should be made only after the precisely assessing life pretensions. Once an a assessment of the conditions has been made, you need to the machinate it with the objects of a collaborative fund scheme to the find out if investing in it yields you the asked result. Like individualities, collaborative finances too come with the particular ideal, and it is on the investors to gauge if their objects are in sync with the collaborative fund scheme they are going to invest.

5. Fund History

You can rest your collaborative fund selection exertion on the fund history. Collaborative finances having a more extended history are the considered good. Also, a collaborative fund is judged predicated on how well it is had performed over a good range of timeframe, especially when the requests were in a bad phase. This data will not be available for a lately launched fund. Investors should be consider at least five times of a fund’s history before making any investment- related decision.

6. Performance of Fund director

The fund director plays a significant part in the success of a fund. Fund directors handle the investors’ capitalist; it is the fund director’s moxie that allows them to the make profits.However, also the fund would see good returns, If a fund director is suitable to the recognize the openings to make profitable investments. Hence, the fund director must have a good track record.

Advantages of Investing in Swish Collaborative Finances

Expert Money Management

Since collaborative finances are managed by a fund director, the chances of the making earnings are on the advanced side. Every fund director is backed by a team of the judges and experts who do the disquisition and choose the best- performing instruments to the involved in the fund’s portfolio. Therefore, you do not have to the retain request knowledge

Option to invest small amounts regularly

One of the most significant advantages of investing in collaborative finances is that you can stagger your investments over time by the taking the Draft or regular investment plan route. Through an a Draft, you can invest a fixed sum as low as Rs 100 on a regular base. This alleviates the need to arrange for the lump sum to get started with the your investment trip.

Diversification

On investing in collaborative finances, you automatically diversify your portfolio across some instruments. Every collaborative fund invests in the some securities, thereby furnishing investors with the benefit of the exposure to a diversified portfolio.

Can redeem at any time

Utmost collaborative fund schemes are open- ended. Therefore, you can redeem your collaborative fund units at any time. This ensures that investors are the handed with the benefit of liquidity and hassle-free retirement at the all times.

Well regulated

All collaborative fund houses are under the horizon of the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). Incremental from these, the Association of Mutual Finances in India (AMFI), a tone-nonsupervisory formed by the fund houses, also keeps an a eye on the fund plans. Therefore, investments made in the collaborative finances are safe.

Duty-effective

Still, 1961, also you can invest in the equity- linked saving scheme (ELSS) or duty- saving collaborative finances, If you are looking to the save impositions under the vittles of Section 80C of the Income Tax Act. These collaborative finances give duty deductions of the over to Rs a time, which helps you save up to the Rs a time in impositions.

Trouble Held by Swish Collaborative Finances

As mentioned ahead, the trouble position of the collaborative finances varies across types. Equity finances carry the topmost situations of trouble since they mainly invest in the equity shares of the companies across request capitalisations. These finances are the easily told by request movements.

The following are the types of risks that come attached with equity finances

Request Trouble

Request trouble is the trouble which can be affect in losses due to the underperformance of the request. Several factors affect request movements. To name a numerous; natural disasters, viral outbreaks, political uneasiness, and so on.

Attention Trouble

Attention generally refers to emphasising on one particular thing. Concentrating your investments towards a particular company is norway judicious. No doubt that having your investments concentrated on one sector proves to be salutary at times when that sector performs well, but if there is any adverse development, also your losses will be magnified.

Interest Rate Trouble

The interest rates change on the base of the vacuity of credit with lenders and the demand from borrowers. The rise in the interest rates during the investment term can affect in a drop in the price of securities.

Liquidity Trouble

Liquidity trouble refers to the difficulty in exiting the holding of a security at a loss. This generally happens when the fund director fails to find buyers.

Credit Trouble

Credit trouble refers to the possibility of a script wherein the issuer of the security fails to pay the interest that was promised at the time of issuing the securities. You can gauge the credit trouble by looking at the credit conditions given by various credit standing agencies.

The following are the types of risks that come attached with equity finances

Interest Trouble

It's the possibility of the rate of interest varying. This may be due to a variety of factors. A change in the rate of interest has a direct impact on the returns offered by the beginning securities.

Credit Trouble

It's the possibility of the issuer of the securities defaulting on the repayment of star and the payment of interest at the rate agreed upon at the time of issuing the securities.

Liquidity Trouble

It's the possibility that the beginning securities may turn illiquid and the fund director may find it delicate to sell the securities held under the portfolio.

Types of Collaborative finances to invest

Invest in the swish type of the fund that is in line with your financial pretensions

1. Top Draft Collaborative Finances

Regular investment plans ( Drafts) allow investors to the invest small amounts periodically. Investors are given the liberty to the decide the frequency and quantum of their investment being made through SIP.

2. Top Equity Collaborative Finances

Equity Collaborative finances invest generally in the equity instruments analogous as stocks. These finances have the eventuality to offer the topmost returns among all the collaborative finances.

3. Top Small-Cap Mutual Finances

Small-cap collaborative finances are a class of the equity finances that invest mainly in equity shares of the those companies that are classified under small request capitalisation.

4. Top Large-Cap Mutual Finances

Large-cap collaborative finances are a class of the equity collaborative finances that invest generally in equity shares of the large-cap companies. These companies are not affected important by the request oscillations.

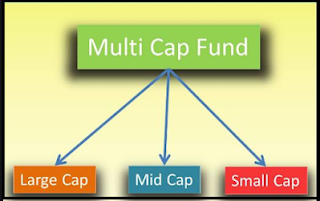

5. TopMulti-Cap Mutual Finances

Multi-cap collaborative finances invest in the equity shares of the companies across all request capitalisations. Investing in multi-cap finances is the swish way to the diversify your portfolio.

6. Top Duty Saving Collaborative Finances

Equity- linked savings scheme (ELSS) or duty- saving finances are equity- acquainted finances and are covered under the Section 80C of the Income Tax Act, 1961. Investors can avail duty deductions of the over to Rs a time by the investing in these finances.

7. TopMid-Cap Collective Finances

Mid-cap finances are equity finances that invest in equity shares of the companies whose request capitalisation is in the range of the Rs 500 crore to Rs crore.

8. Top Liquid Finances

Liquid finances are a class of debt finances that invest in the high-rated debt instruments similar as storeroom bills. These are a better option than regular savings bank accounts to the demesne idle plutocrat.

9. Top Debt Collective Finances

Debt collective finances invest in the instruments similar as commercial bonds, government bonds, storeroom bills, and so on, that offer regular tip payouts.

10. Top Short- Term Collective Finances

Short- term collective finances are an ideal option for the threat-antipathetic investors. The maturity period of these finances is between the 15 days and 91 days.

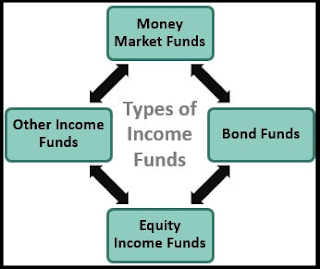

11. Top Income Finances

Income finances generally invest in the securities that are able of the furnishing high tips. They generally invest in the bonds, debentures and preference shares.

12. Top Balanced Collective finances

Balanced or cold-blooded finances invest across both the debt and equity instruments. Investing in these finances is the best way to the diversify one’s portfolio.

No comments:

Post a Comment